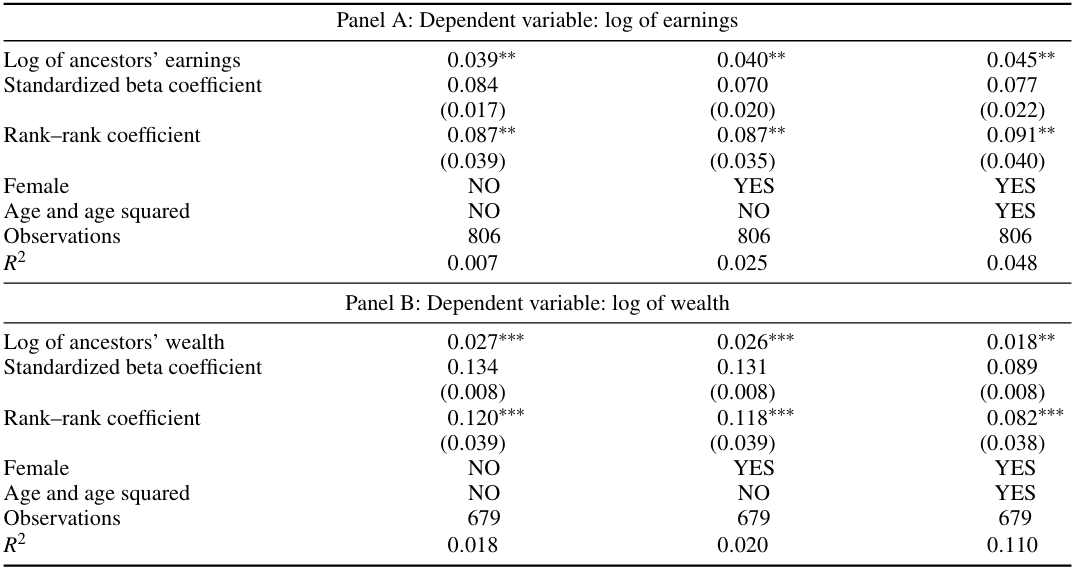

The working paper by Stuhler (2012) provides an easy-to-read introduction to the iteration regression fallacy and provides several theoretical frameworks that can help explain the discrepancy.

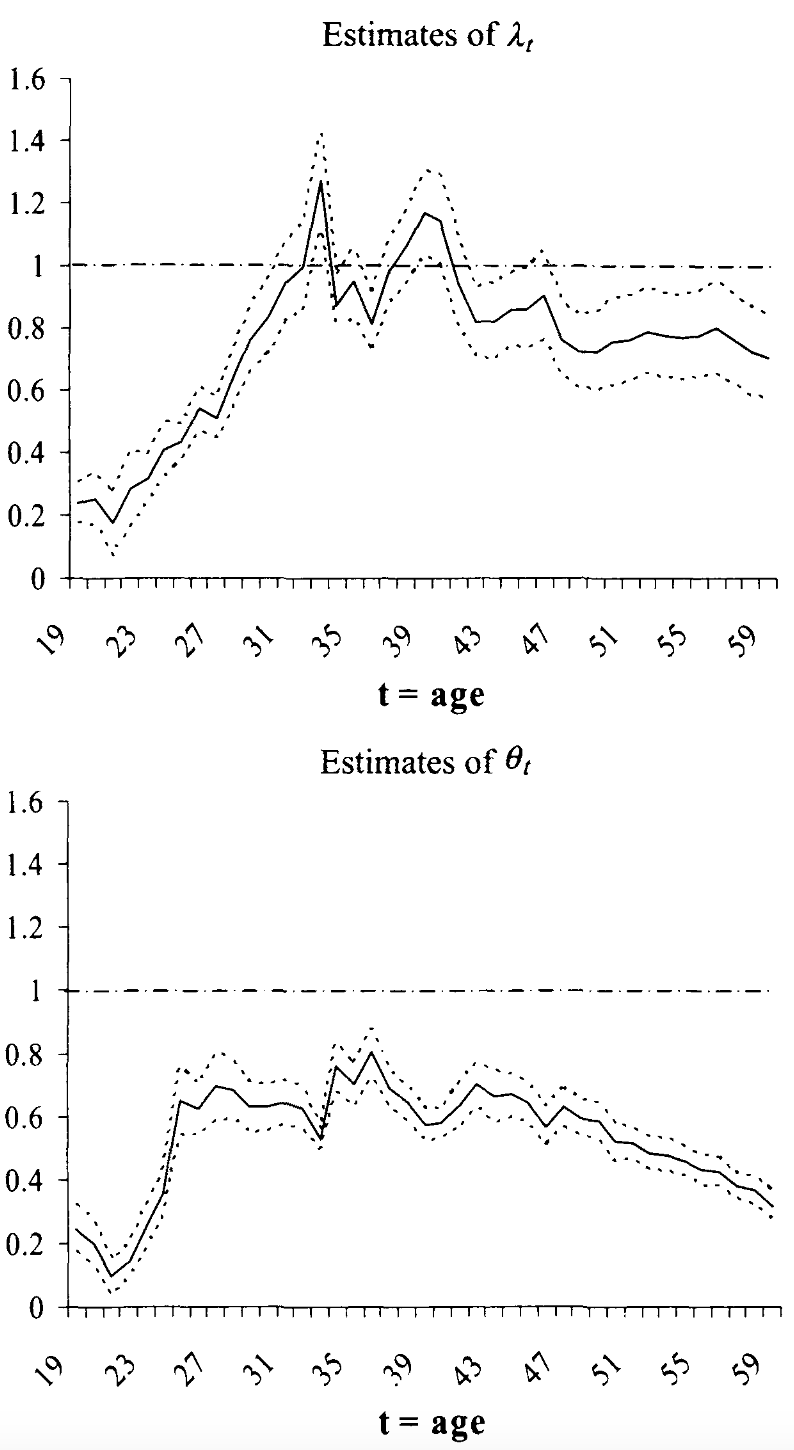

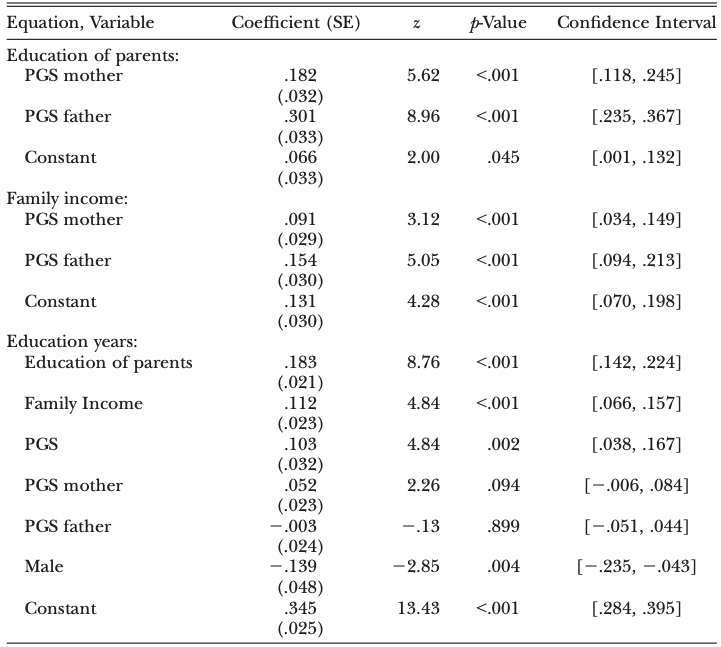

First, let’s consider latent endowment (for example, genetics). Let’s assume that income in each generation \(t\), \(y_{it}\), is determined by the endowment value of that generation \(e_{it}\). The endowment process is an AR(1) process with persistence parameter \(\lambda\). In this model,

\[

\beta_{-1} = \rho^2 \lambda \qquad\qquad \beta_{-2} = \rho^2 \lambda^2

\]

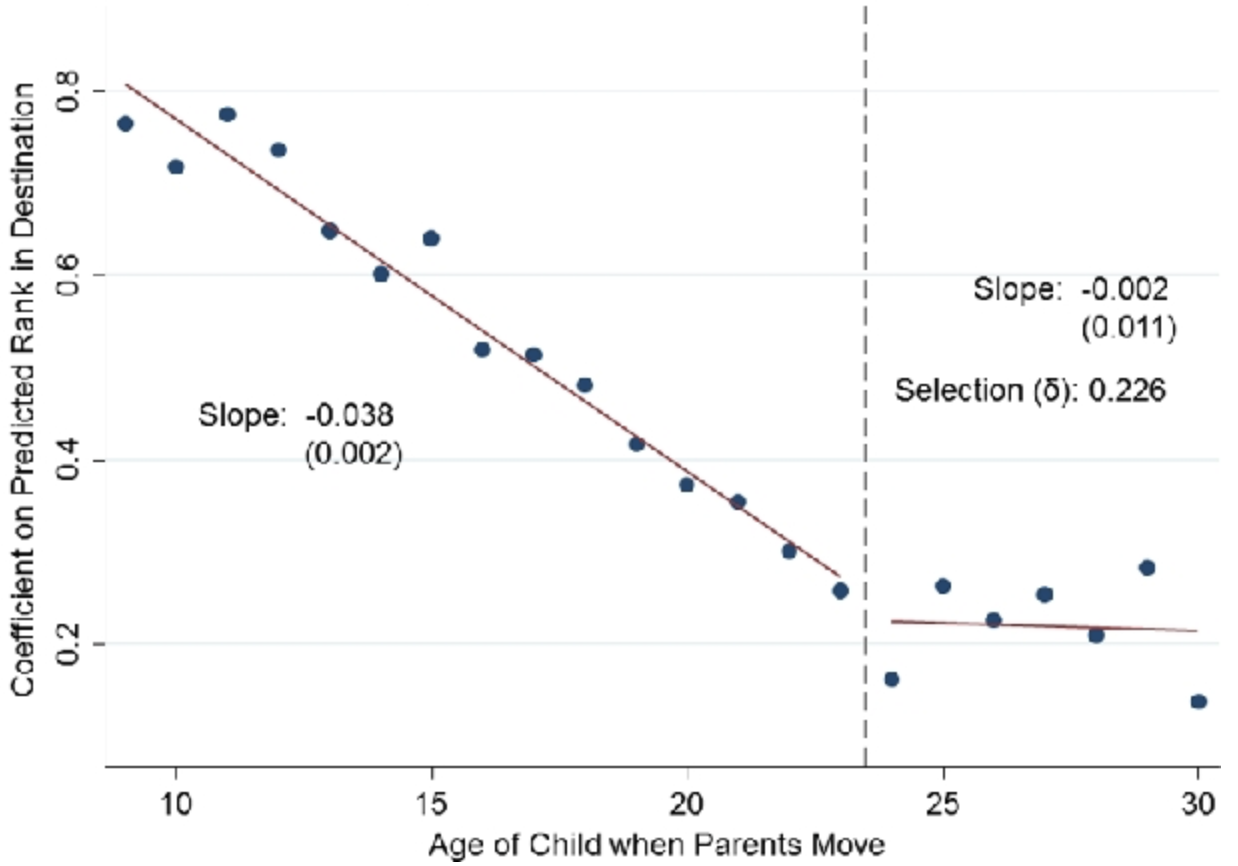

It is now easy to see that \(\left(\beta_{-1}\right)^2 - \beta_{-2} = \rho^4\lambda^2 - \rho^2\lambda^2 = \left(\rho^2 - 1\right)\rho^2\lambda^2\). So, for \(\rho \in [0, 1]\) and \(\lambda \in [0, 1]\), the discrepancy is negative. We can also make this reasoning a little more refined and add human-capital accumulation in the picture. The result will be similar with a small adjustment for conversion of latent endowment to human capital. This framework allows us to reason about possible long-run effects of schooling reforms, for example. So, it can be that the reforms raise mobility within one generation by making schooling less dependent on family characteristics. However, if they do not affect the heritability of traits (for example, no changes to assortative mating), then these policies will not change long-run (multi-generational) mobility.

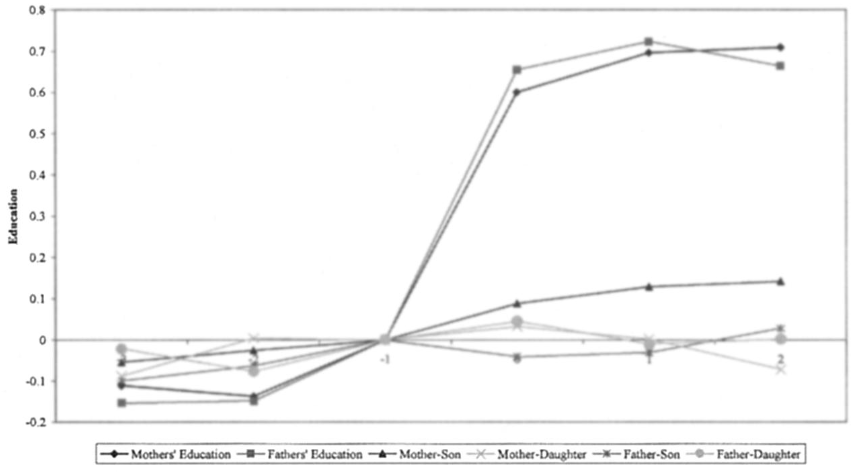

Second, children do not just inherit one endowment, but a whole host of them. Even if endowment is genetically transmitted, the genes determine numerous traits, which can enter the earnings process differently. So, suppose each generation has two endowments \(e_{1it}\) and \(e_{2it}\), each inherited with persistence \(\lambda_1\) and \(\lambda_2\) and entering the earnings process with coefficients \(\rho_1\) and \(\rho_2\). Then, the iterated regression fallacy parameter is negative as long as \(\lambda_1 \neq \lambda_2\). So, continuing with the genetic transmission example, \(e_{1i}\) may be race (close to perfect heritability) and \(e_{2it}\) cognitive intelligence (more malleable characteristic).

Third, as mentioned above, grand-parents and even more distant ancestors may have a direct impact on current generation, in addition to their indirect influence on parents. The expression for the discrepancy becomes massive and harder to interpret, but it also suggests that iterative parameter underestimates the long-run correlation.

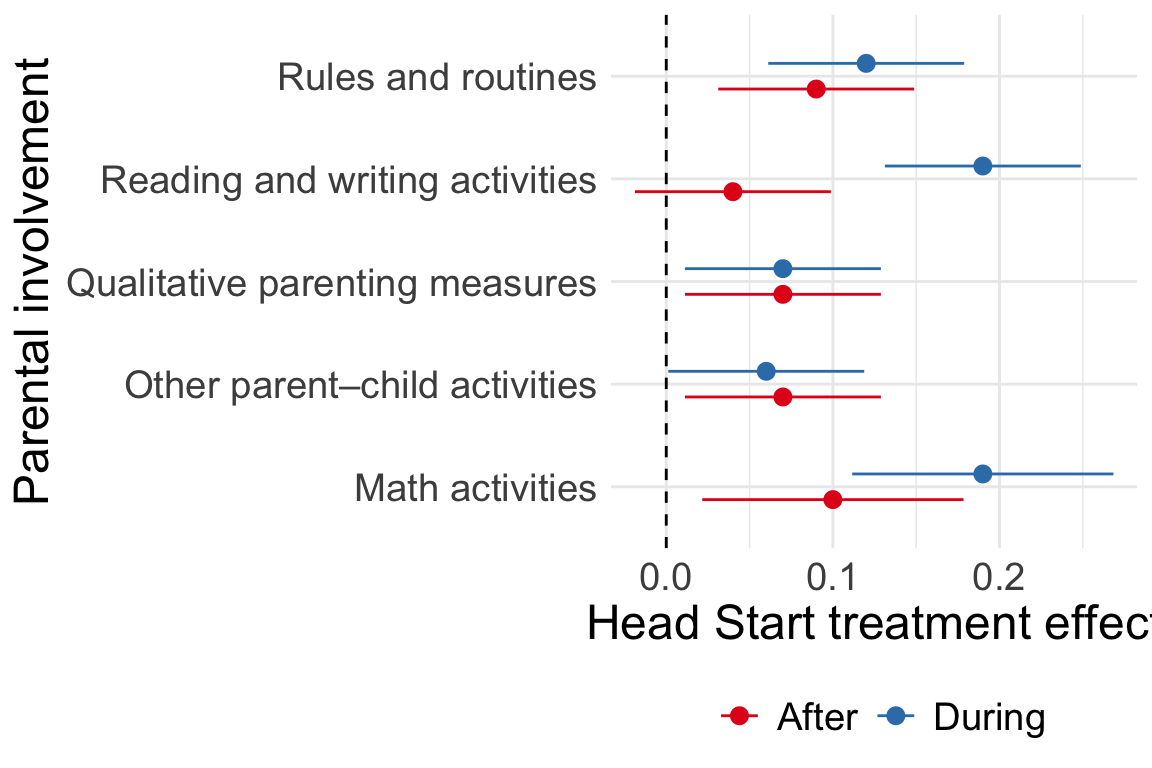

Finally, Stuhler (2012) also describes a model with parental investments where \(y_{i, t - 1}\) enters into endowment generation process (for example, their investments into human capital) or directly in earnings process for \(y_{it}\) (for example, parents’ networks may affect earnings of children besides the human capital channel). He shows that in the second case, the iterated regression fallacy can be biased in the opposite way if the direct impact of \(y_{it-1}\) on \(y_{it}\) is stronger than heritability of endowments.