| 1930 cohort | 1940 cohort | |

|---|---|---|

| r | 0.076 | 0.095 |

| (0.029) | (0.022) | |

| Weak IV F-stat | 1.6 | 3.2 |

4. Human Capital

KAT.TAL.322 Advanced Course in Labour Economics

March 14, 2024

Human capital

Labour heterogeneity is important for labour supply and demand.

Human capital includes education, training, health investments.

First references as early as Adam Smith; formalised by Becker in 1960s.

Overview

Overview

Human capital is an investment

- benefit: gain in earnings

- cost: tuition, foregone earnings, psychological costs

Two main camps for source of gain in earnings:

gain in productivity

signalling

Human capital production function

Typically, univariate (years of education), but can be complex function of

Innate skills (e.g., genetics)

Parental investments (e.g., day care, time spent with children, tutors)

Schooling/formal education

- Quantity (e.g., high school vs university)

- School quality (e.g., teacher quality, expenditure per student)

- Differences in curricula/fields (e.g., STEM vs arts)

Peers (e.g., at school, at work)

On-the-job training (e.g., general vs specific skills)

Productive human capital investments

Basic model

Assume education choice \(S \in \{HS, C\}\)

Worker with \(s\) produces \(Y_s\) goods when employed by a firm, \(\forall s \in S\).

Perfect competition ensures that \(W_{HS} = Y_{HS}\) and \(W_C = Y_C\)

Assume cost of education given by function \(\eta(S)\)

Then choose college if marginal benefit outweighs marginal cost

\[ S = C \iff \color{#288393}{W_{C} - W_{HS}} \geq \color{#9a2515}{\eta(C) - \eta(HS)} \]

Lifecycle model: simplified Ben-Porath (1967)

- Divide time between schooling/training \(\sigma(t)\) and working \(1 - \sigma(t)\)

- Law of motion of HC: \(\dot{h}(t) = \theta \sigma(t)h(t)\)

- Production function per worker: \(y(t) = Ah(t)\) = wage

- Assume linear utility and no utility cost of \(\sigma(t)\)

\[ \Omega = \int_0^T \left(1 - \sigma(t)\right) Ah(t)e^{-rt} dt \qquad \text{s.t. HC law of motion} \]

Marginal return to HC effort \(\sigma(t)\) is

\(\frac{\partial \Omega}{\partial \sigma(t)} = -Ah(t)e^{-rt} + \int_0^T \left(1 - \sigma(z)\right) A\frac{\partial h(z)}{\partial \sigma(t)} e^{-rz} dz\)

\(\frac{\partial \Omega}{\partial \sigma(t)} = \color{#8e2f1f}{\underbrace{-Ah(t)e^{-rt}}_\text{foregone earnings}} + \color{#288393}{\underbrace{A\theta\int_t^T \left(1 - \sigma(z)\right) h(z) e^{-rz} dz}_\text{discounted future payoff}}\)

Lifecycle model: simplified Ben-Porath (1967)

Optimal effort is zero at low efficiency \(\theta\) and high discount rate \(r\)

The change in marginal return over time is given by

\[ \frac{d}{dt}\left(\frac{\partial \Omega}{\partial \sigma(t)}\right) = A h(t) e^{-rt}(r - \theta) \]

If \(r > \theta\), then marginal return \(\uparrow\) over time, but is negative at \(T\):

\[ \frac{\partial \Omega}{\partial \sigma(T)} = -Ah(T)e^{-rT} < 0 \]

Hence, marginal return at every period is negative \(\Rightarrow \sigma^*(t) = 0 \quad \forall t\).

Lifecycle model: simplified Ben-Porath (1967)

Optimal effort when efficiency \(\theta\) is high or discount rate \(r\) is low

Marginal return \(\downarrow\) over time \(\Rightarrow\) may exist \(t = s\) such that \(\frac{\partial \Omega}{\sigma(s)} = 0\)

- initial investment into education \(\sigma^*(t) = 1, \quad \forall t \leq s\)

- work rest of the time \(\sigma^*(t) = 0, \quad \forall t > s\)

- study longer if \(\theta\) higher

\[s = \begin{cases}T + \frac{1}{r}\ln\left(\frac{\theta - r}{\theta}\right) & \text{if } \theta \geq \frac{r}{1 - e^{-rT}} \\ 0 & \text{otherwise}\end{cases}\]

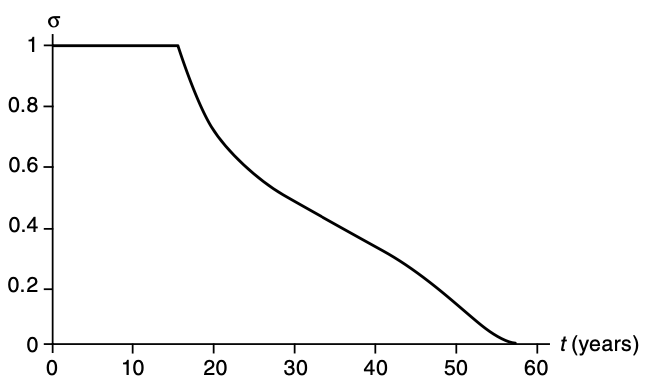

Lifecycle model: Ben-Porath (1967)

Allows for human-capital depreciation and on-the-job training

Source: Figure 4.9 from Cahuc (2004)

Signalling theory

Basic model

- Two types of productivity \(\theta_H\) and \(\theta_L\)

- Education \(e\) costs \(c_i = \frac{e}{\theta_i}\)

- Linear utility \(w - c_i, ~ \forall i \in \{H, L\}\)

Observable types

Free entry ensure \(w = \theta_i \Rightarrow e_i^* = 0, ~\forall i \in \{H, L\}\)

Unobservable types

- Low type gets no education \(e_L^* = 0\) and a payoff \(\theta_L\)

- High type gets \(e_H^* = \theta_L\left(\theta_H - \theta_L\right)\) and a payoff \(\theta_H - \frac{\theta_L\left(\theta_H - \theta_L\right)}{\theta_H}\)

Returns to education

J. Mincer (1958)

- \(E(S)\) earnings with \(S\) years of schooling

- Assume no direct cost of education

- Internal rate of return: \(r\) that equates costs and benefits

Present value of earnings \(P(S) = \int_S^T E(S) e^{-rt} dt = E(S) \frac{e^{-rS} - e^{-rT}}{r}\)

\[ P(S) = P(0) \Rightarrow \ln E(S) \approx \ln E(0) + rS \]

| Regression | \(R^2\) |

|---|---|

| \(\ln w = 7.58 + 0.070 S\) | 0.067 |

J. A. Mincer (1974)

Accounting for experience

Building on Ben-Porath (1967)

- \(t(x)\) share of time dedicated to training at \(x\) experience and \(s\)

- HC law of motion: \(\dot{h}(s + x) = \rho_1 t(x)h(s + x), ~ \forall x \in [0, T - s]\)

\[\ln w(s + x) = \ln w(0) + \rho s + \rho_1 t(0) x - \rho_1\frac{t(0)}{2T} x^2\]

| Regression | \(R^2\) |

|---|---|

| \(\ln w = 6.20 + 0.107 S + 0.081 X - 0.0012 X^2\) | 0.285 |

OLS estimates of returns to schooling

Potential issues

Endogeneity of schooling and earnings

- Cognitive and noncognitive abilities (Heckman, Stixrud, and Urzua 2006)

Return to education is same regardless of duration of study

Does not take into account direct costs of education

Heterogeneity of returns (e.g., family background, schooling system)

Years of schooling vs qualifications

Productivity vs signalling interpretation

Causal estimates of returns to schooling

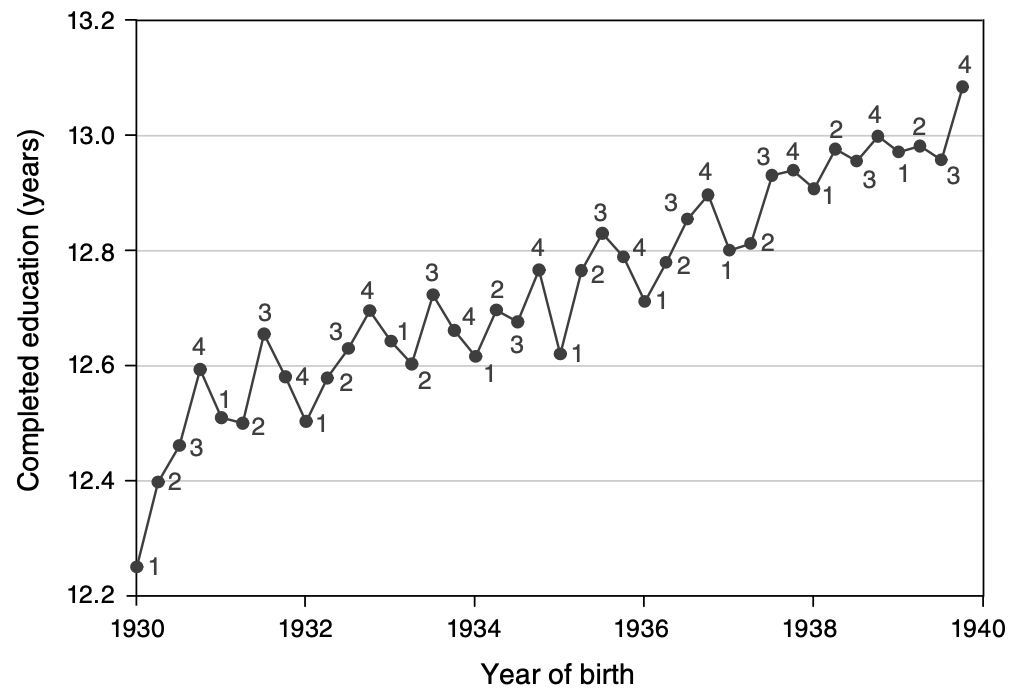

Angrist and Krueger (1991)

Compulsory schooling laws: exogenous variation by quarter of birth

Instrumental variable approach

Local Average Treatment Effect (LATE)

\[ \begin{align} \ln W_{icq} &= \beta X_i + \rho E_i + \sum_c 1\{YOB_i = c\}\xi_c + \mu_i \\ E_{icq} &= \pi X_i + \sum_c 1\{YOB_i = c\}\delta_c + \sum_c\sum_q1\{YOB_i = c\} 1\{QOB_i = q\}\theta_{qc} + \epsilon_i \end{align} \]

Causal estimates of returns to schooling

Angrist and Krueger (1991)

IV estimates of returns to education \(\rho\)

Issues:

Instrument is weak (IV estimates are inflated)

Who are the compliers? Endogeneity? External validity?

Causal estimates of returns to schooling

Some other IV approaches

| Instrument | Estimated \(\rho\) | |

|---|---|---|

| Card (1993) | Proximity to college | 0.132 (0.055) |

| Cameron and Taber (2004) | Proximity to college | 0.228 (0.109) |

| Cameron and Taber (2004) | Earnings in local labour market | 0.057 (0.115) |

| Kane and Rouse (1995) | College tuition fees | 0.116 (0.045) |

| Oreopoulos (2007) | Changes in compulsory schooling laws | 0.133 (0.0118) US 0.084 (0.0267) Canada 0.158 (0.0491) UK |

Causal estimates of returns to schooling

Twin studies

\[ \begin{align} \ln w_{ij} &= \alpha + \rho s_{ij} + A_j + \varepsilon_{ij}, ~\forall i \in \{1, 2\} \\ \Delta \ln w_j &= \rho \Delta s_j + \Delta \varepsilon_j \end{align} \]

| Estimated \(\rho\) | |

|---|---|

| Ashenfelter and Rouse (1998) | 0.088 (0.025) |

| Oreopoulos and Salvanes (2011) | 0.0476 (0.0026) |

Causal estimates of returns to schooling

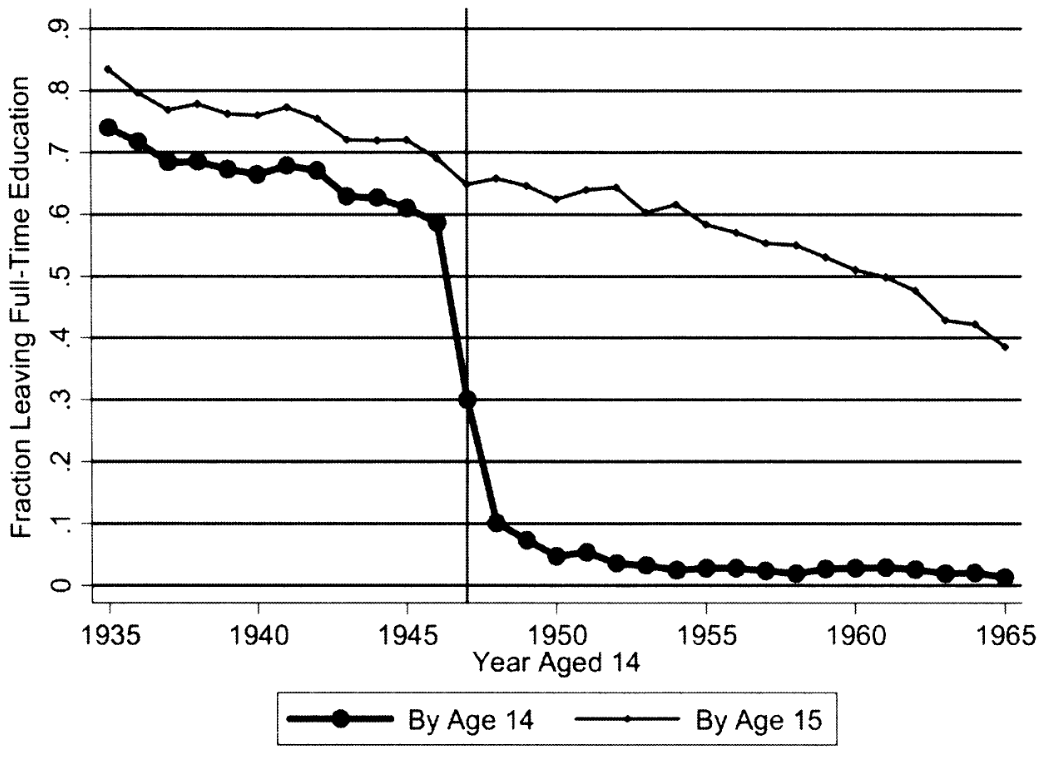

Regression discontinuity design: Oreopoulos (2006)

UK 1947: raised min school leaving age (ROSLA) from 14 to 15

Compare similar people just before and after policy change

Estimated \(\rho\) = 0.069 (0.040)

Second reform in 1972: min SLA \(\uparrow\) from 15 to 16

Small (or zero) return (Dickson and Smith 2011)

Causal estimates of returns to schooling

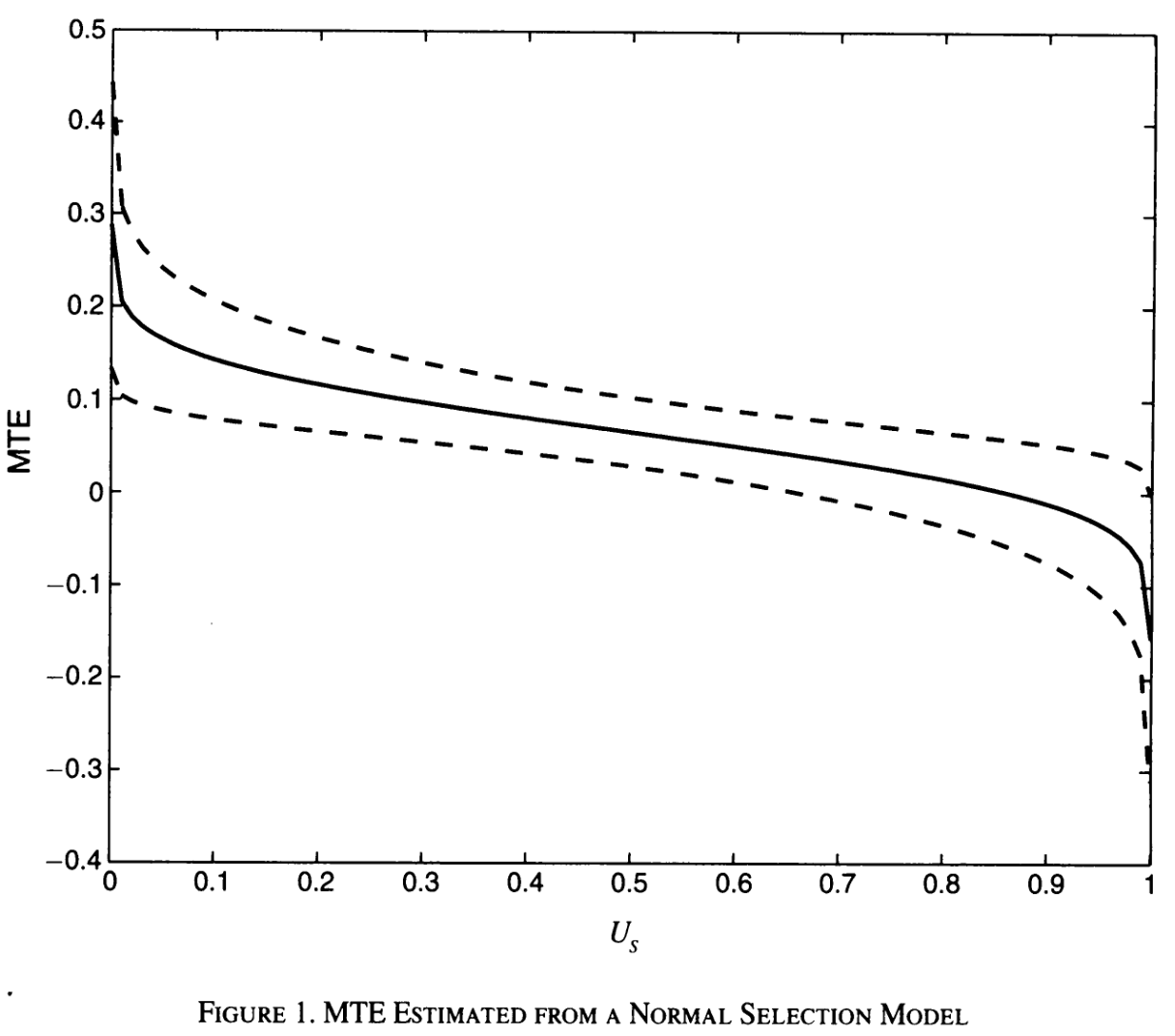

Carneiro, Heckman, and Vytlacil (2011)

- Many papers estimate sizable returns to schooling

- Average dropout rate in OECD 17% in 2020

- Heterogeneity in returns to schooling

Role of individual characteristics? E.g., patience (Cadena and Keys 2015)

Causal estimates of returns to schooling

Productivity or signalling?

Hard question to answer

Productivity

- [No] upstream effects of ROSLA on qualifications (Chevalier et al. 2004)

- Student riots, \(\uparrow\) passes, \(\uparrow\) higher edu, \(\uparrow\) wages (Maurin and McNally 2008)

- RDD of just passing/failing high school exam: no effect (Clark and Martorell 2014)

Signalling

- Employer learning: 30% of returns due to signalling (Aryal, Bhuller, and Lange 2022)

- Positive effect of degree classes (Feng and Graetz 2017)

Summary

Education is a human capital investment

Models describing the investment decisions treat education as productivity enhancing and/or signalling device

Empirical estimates suggest sizable wage returns to a year of schooling

However, still a lot of debate about causality, heterogeneity and interpretation

Next: Education Quality