3. Labour Demand

KAT.TAL.322 Advanced Course in Labour Economics

September 1, 2025

Labour demand

Firm decisions about how much labour to hire

Static model

Static model

Single factor input

Production function \(Y = F(L)\) where \(F^\prime > 0\) and \(F^{\prime\prime} < 0\)

\[ \max_{L} PF(L) - WL \]

FOC: \(F^\prime(L) = \frac{W}{P}\)

Downward-sloping labour demand

\[ \frac{\partial L}{\partial W} = \frac{1}{PF^{\prime\prime}(L)} < 0 \]

Static model

Two factor inputs: conditional factor demand

Production function \(Y = F(L, K)\) where \(F_L > 0, F_K > 0, F_{LL} < 0, F_{KK} < 0\)

Cost minimization problem: \(\min_{L, K} C(L, K) = WL + RK\) s.t. \(F(L, K) = \bar{Y}\)

Conditional demand: \(\bar{K}(W, R, \bar{Y})\) and \(\bar{L}(W, R, \bar{Y})\)

\[ \frac{F_L(\bar{L}, \bar{K})}{F_K(\bar{L}, \bar{K})} = \frac{W}{R} \quad\text{and}\quad F(\bar{L}, \bar{K}) = \bar{Y} \]

Static model

Two factor inputs: conditional demand elasticities

Own-price elasticities: \(\eta_W^L = \frac{\partial \ln \bar{L}}{\partial \ln W} < 0\) and \(\eta_R^K = \frac{\partial \ln \bar{K}}{\partial \ln R} < 0\)

Cross-price elasticities: \(\eta_R^L = \frac{\partial \ln \bar{L}}{\partial \ln R} > 0\) and \(\eta_W^K = \frac{\partial \ln \bar{K}}{\partial \ln W} > 0\)

Elasticity of substitution \(\sigma = \frac{\partial \ln\left(\frac{K}{L}\right)}{\partial \ln \left(\frac{W}{R}\right)} > 0\)

It is also possible to show that

\[ \eta_R^L = \sigma (1 - s) \quad \text{and} \quad \eta_W^L = -\sigma(1 - s) \]

where \(s = \frac{WL}{C}\) is labour share in total cost

Static model

Two factor inputs: unconditional factor demand

Second step: \(\max_{Y} PY - C(W, R, Y)\)

Solution: \(P = C_Y(W, R, Y^*), L^* = \bar{L}(W, R, Y^*), K^* = \bar{K}(W, R, Y^*)\)

Total elasticities decomposed into substitution and scale effects:

\[ \varepsilon_W^L = \color{#8e2f1f}{\eta_W^L} + \color{#288393}{\eta_Y^L \varepsilon_W^Y} < 0 \]

\[ \varepsilon_R^L = \color{#8e2f1f}{\eta_R^L} + \color{#288393}{\eta_Y^L\varepsilon_R^Y} \lessgtr 0 \]

Estimations of static model

Empirical strategy

Shephard’s lemma: \(\bar{L} = \frac{\partial C}{\partial W} \quad \Rightarrow \quad s = \frac{\partial \ln C}{\partial \ln W}\)

Specify functional form of \(\ln C\)

Example: translog cost function with \(n\) inputs

\[ \ln C = a_0 + \sum_{i = 1}^n a_i \ln W_i + \frac{1}{2} \sum_{i = 1}^n \sum_{j = 1}^n a_{ij} \ln W_i \ln W_j + \frac{1}{\theta} \ln Y \]

Regress input share \(s_i\) on \(\frac{\partial \ln C}{\partial \ln W_i}\)

Use estimated parameters to compute \(\sigma_{ij}\)

Estimations of static model

Main issues

Endogeneity

General equilibrium

Definitions of variables

Estimations of static model

Review by Hamermesh (1996) concludes that \(-\eta_W^L \in [0.15, 0.75]\).

If \(\eta_W^L = -0.30\) and given that \(s \approx 0.7\),

\[ \sigma = \frac{-\eta_W^L}{1 - s} \approx 1 \]

consistent with the Cobb-Douglas production function.

The review also suggests \(-\varepsilon_W^L \approx 1 \Rightarrow\) large scale effect.

Dynamic model

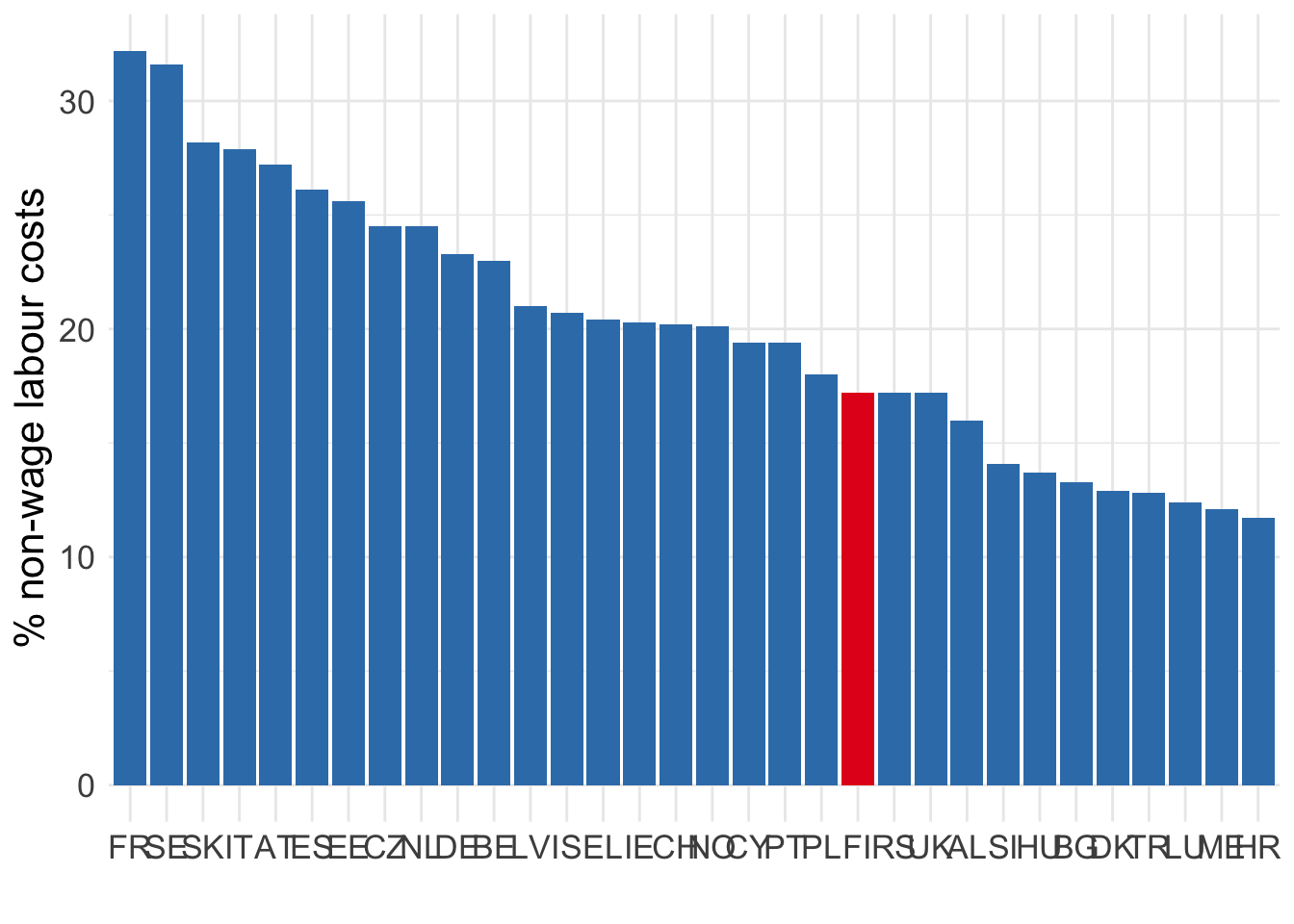

Dynamic model

Non-wage labour costs

Source: Eurostat

Dynamic model

Adjustment costs

Quadratic cost: \(C\left(\Delta L_t\right) = b\left(\Delta L_t - a\right)^2\)

Asymmetric convex costs: \(C\left(\Delta L_t\right) = -1 + e^{a\Delta L_t} - a\Delta L_t + \frac{b}{2}\left(\Delta L_t\right)^2\)

Linear cost: \(C\left(\Delta L_t\right) = \begin{cases}c_h \Delta L_t & \text{if }\Delta L_t \geq 0\\-c_f \Delta L_t & \text{if }\Delta L_t \leq 0\end{cases}\)

Fixed cost

Dynamic model

Quadratic adjustment cost

For simplicity, assume single-input: \(Y_t = F(L_t)\)

Continuous time: \(\Delta L_t = \dot{L}_t = \frac{\text{d} L_t}{\text{d}t}\)

\[ \Pi_0 = \int_0^\infty \Pi_t dt = \int_0^\infty \left[F(L_t) - W_tL_t - \frac{b}{2}\dot{L}_t^2\right]e^{-rt}~\text{d}t \]

Euler equation: \(\frac{\partial \Pi_t}{\partial L} = \frac{\text{d}}{\text{d}t}\left(\frac{\partial \Pi_t}{\partial \dot{L}_t}\right)\)

\[ b\ddot{L}_t - rb\dot{L}_t + F'(L_t) - W_t = 0 \]

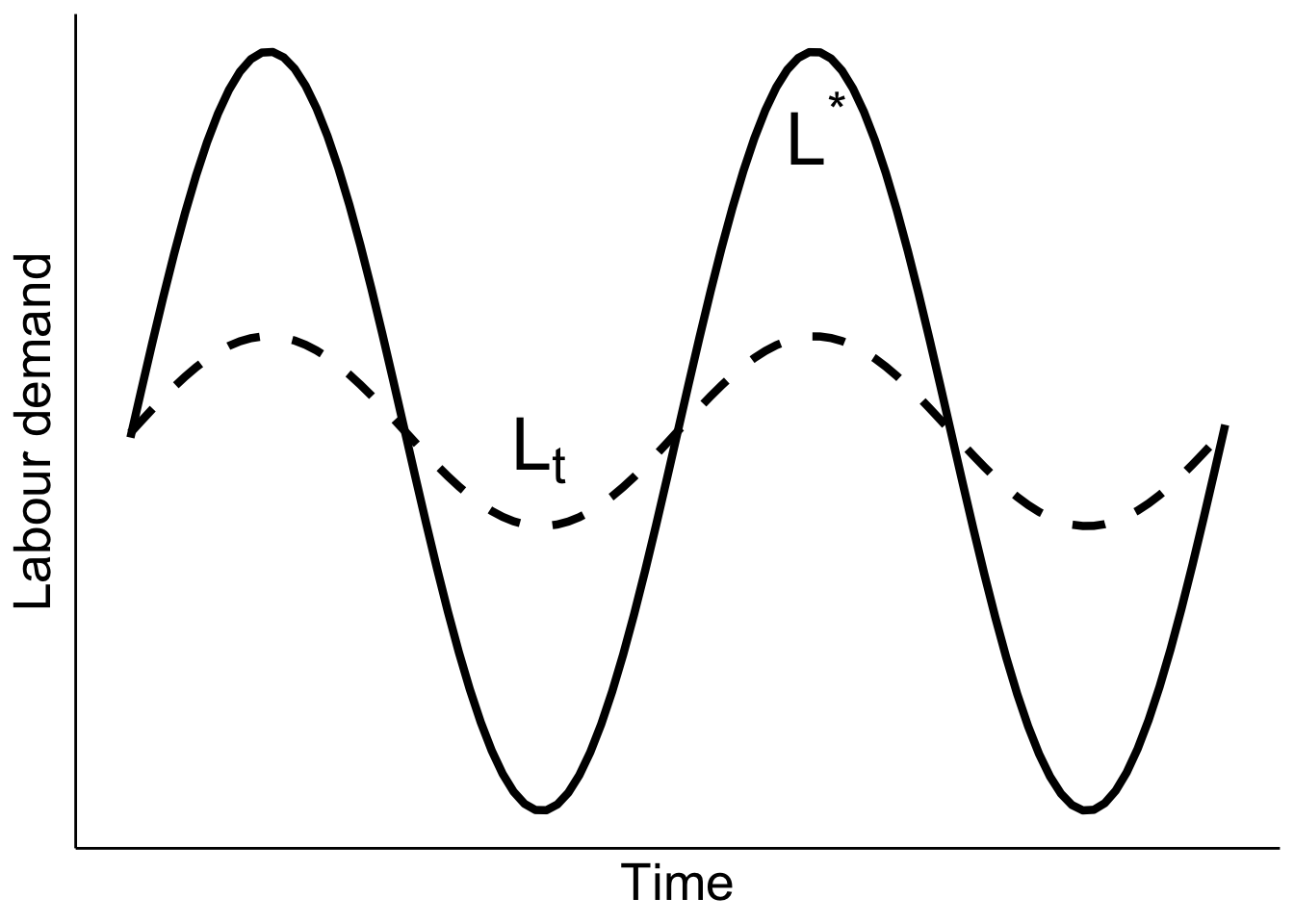

Dynamic model

Quadratic adjustment cost

Optimal path: \(\dot{L}_t = \gamma \left[L^* - L_t\right]\) where \(\gamma\) is decreasing in \(b\).

Figure 9.6 Optimal employment over a cycle (Nickell 1986)

Dynamic model

Linear adjustment cost

\[ \Pi_0 = \int_0^\infty \left[F(L_t) - W_tL_t - C(\dot{L}_t)\right]e^{-rt}dt \]

where \(C\left(\dot{L}_t\right) = \begin{cases}c_h \dot{L}_t & \text{if }\dot{L}_t \geq 0\\-c_f \dot{L}_t & \text{if }\dot{L}_t \leq 0\end{cases}\)

Optimal labour demand path is derived from

\[ \begin{cases}F'(L_t) = W_t + r c_h & \text{if }\dot{L}_t \geq 0 \\ F'(L_t) = W_t - r c_f & \text{if }\dot{L}_t < 0\end{cases} \]

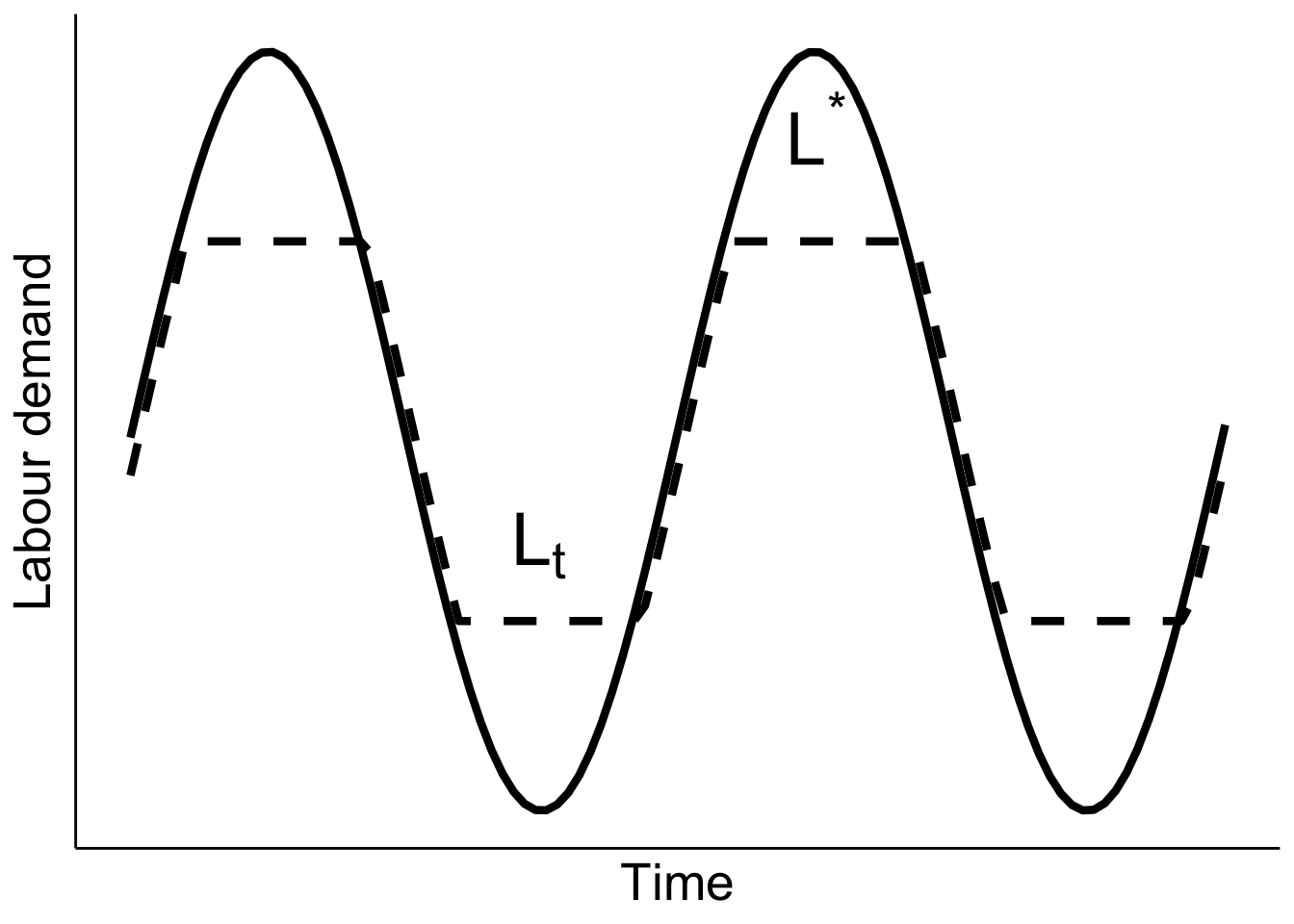

Dynamic model

Linear adjustment cost

Figure 9.10 Optimal employment over the cycle (Nickell 1986)

Estimations of dynamic model

Empirical strategy for adjustment cost specification

Quadratic adjustment cost

Assume linear quadratic production function

Estimate \(L_{it} = \lambda L_{i, t - 1} + X_{it} \beta + \mu_i + \varepsilon_{it}\)

- Need to account for \(\text{Corr}\left(L_{i, t - 1}, \mu_i + \varepsilon_{it}\right)\)

Estimations of dynamic model

Some key results

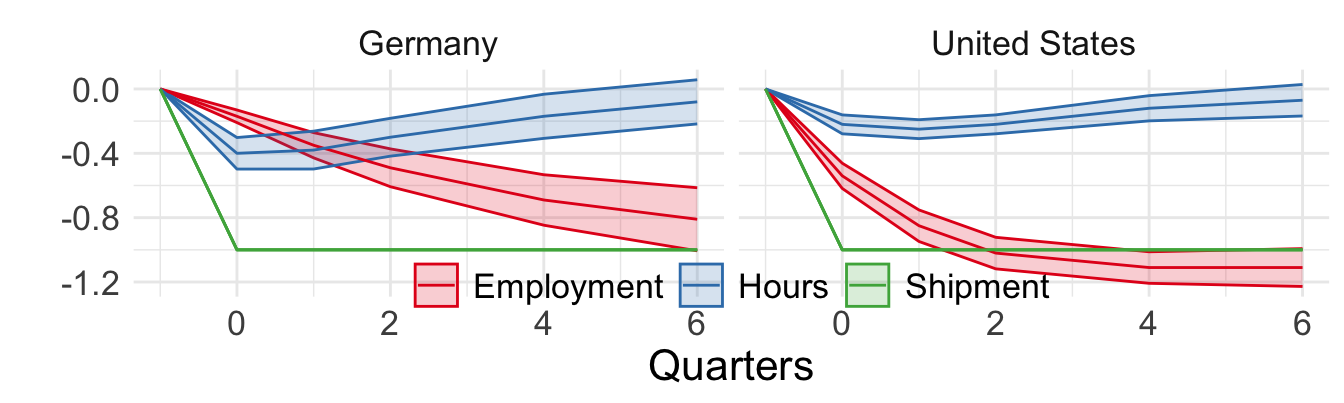

Adjustments happen fast (1-2 quarters) (Hamermesh 1996, chap. 7)

Dynamic substitutes: utilization of capital increases with \(L_t - L^*\)

Hours of work are adjusted faster than number of workers

Figure 1 from Houseman and Abraham (1993) (adjustment to demand shocks)

Minimum wages and employment

Minimum wage and employment

What do the models we have considered so far predict?

lower labour demand (both compensated and uncompensated)

(maybe) higher labour supply

Not always supported by empirical evidence!

Minimum wage and employment

Card and Krueger (1994)

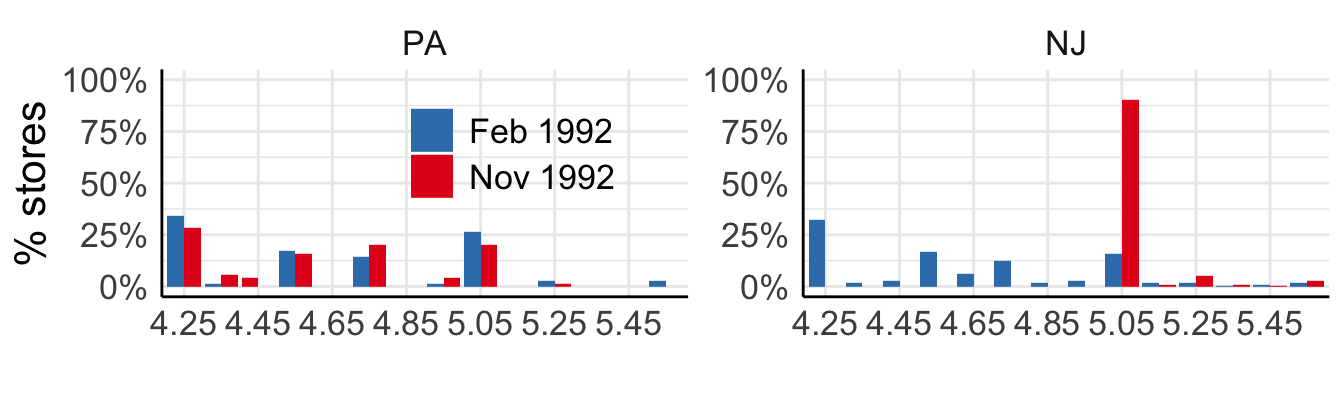

On April 1, 1992 minimum wage in New Jersey \(\uparrow\) from $4.25 to $5.05.

It stayed at $4.25 in Pennsylvania.

Minimum wage and employment

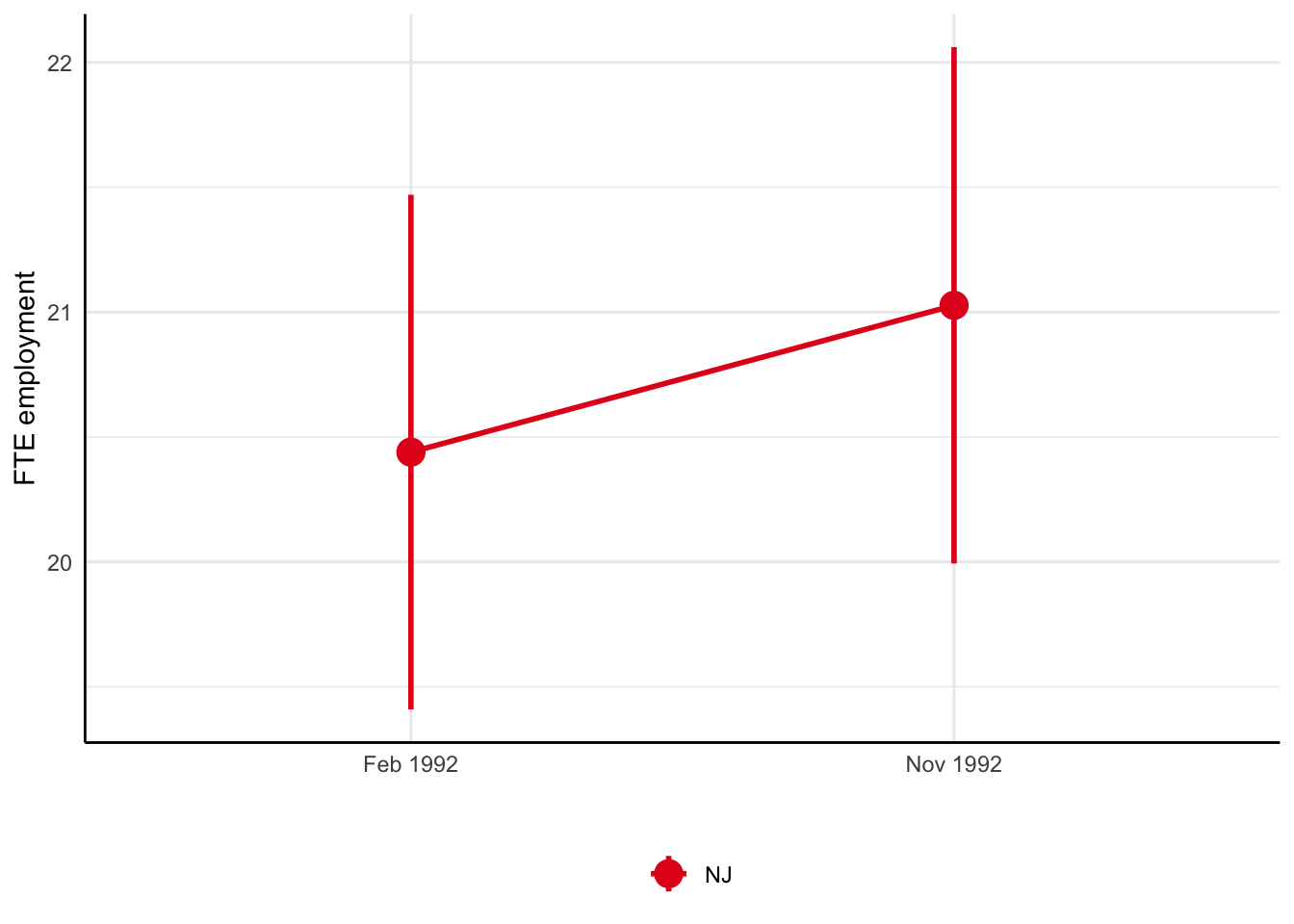

Card and Krueger (1994): Difference-in-differences

- Compare before and after in NJ:

\(E_{t1}^{NJ} - E_{t0}^{NJ}\) = 0.59 (se = 0.73)

Minimum wage and employment

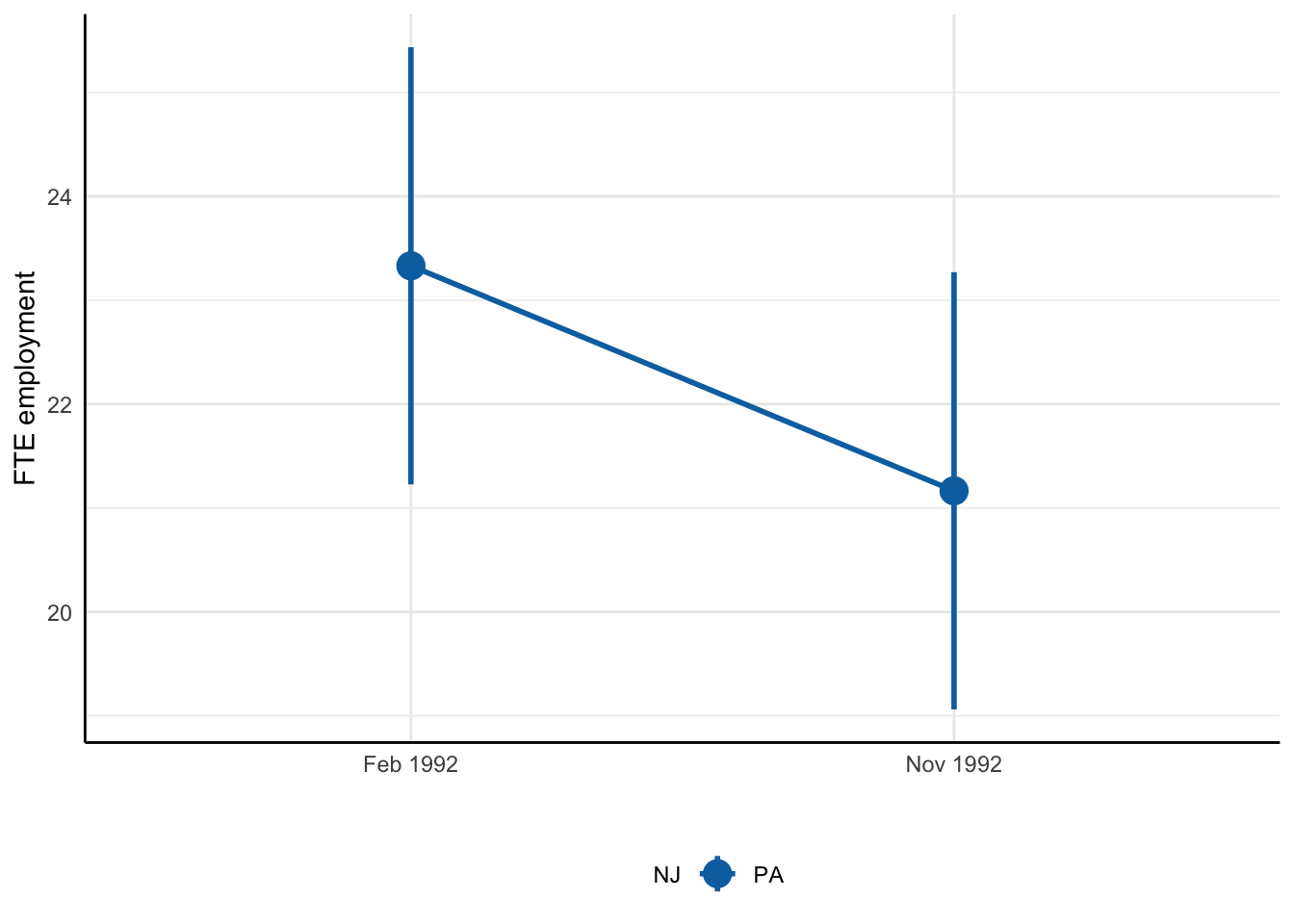

Card and Krueger (1994): Difference-in-differences

- Compare before and after in NJ:

\(E_{t1}^{NJ} - E_{t0}^{NJ}\) = 0.59 (se = 0.73) - Compare before and after in PA:

\(E_{t}^{NJ} - E_{t}^{PA}\) = -2.17 (se = 1.65)

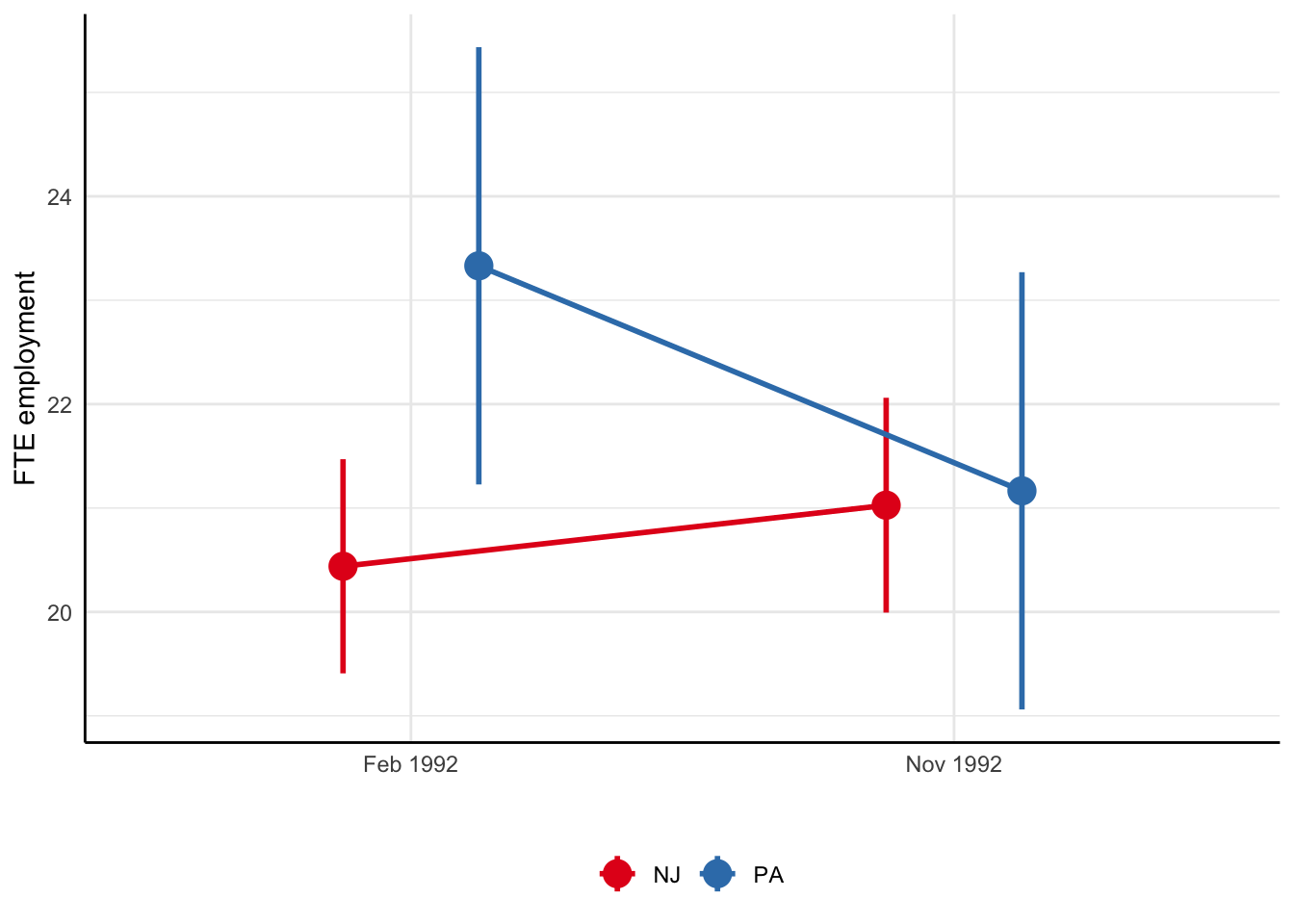

Minimum wage and employment

Card and Krueger (1994): Difference-in-differences

- Compare before and after in NJ:

\(E_{t1}^{NJ} - E_{t0}^{NJ}\) = 0.59 (se = 0.73) - Compare before and after in PA:

\(E_{t}^{NJ} - E_{t}^{PA}\) = -2.17 (se = 1.65) - Diff-in-diff:

\(\left(E_{t1}^{NJ} - E_{t0}^{NJ}\right) - \left(E_{t1}^{PA} - E_{t0}^{PA}\right)\) = 2.75 (se = 1.69)

Minimum wage and employment

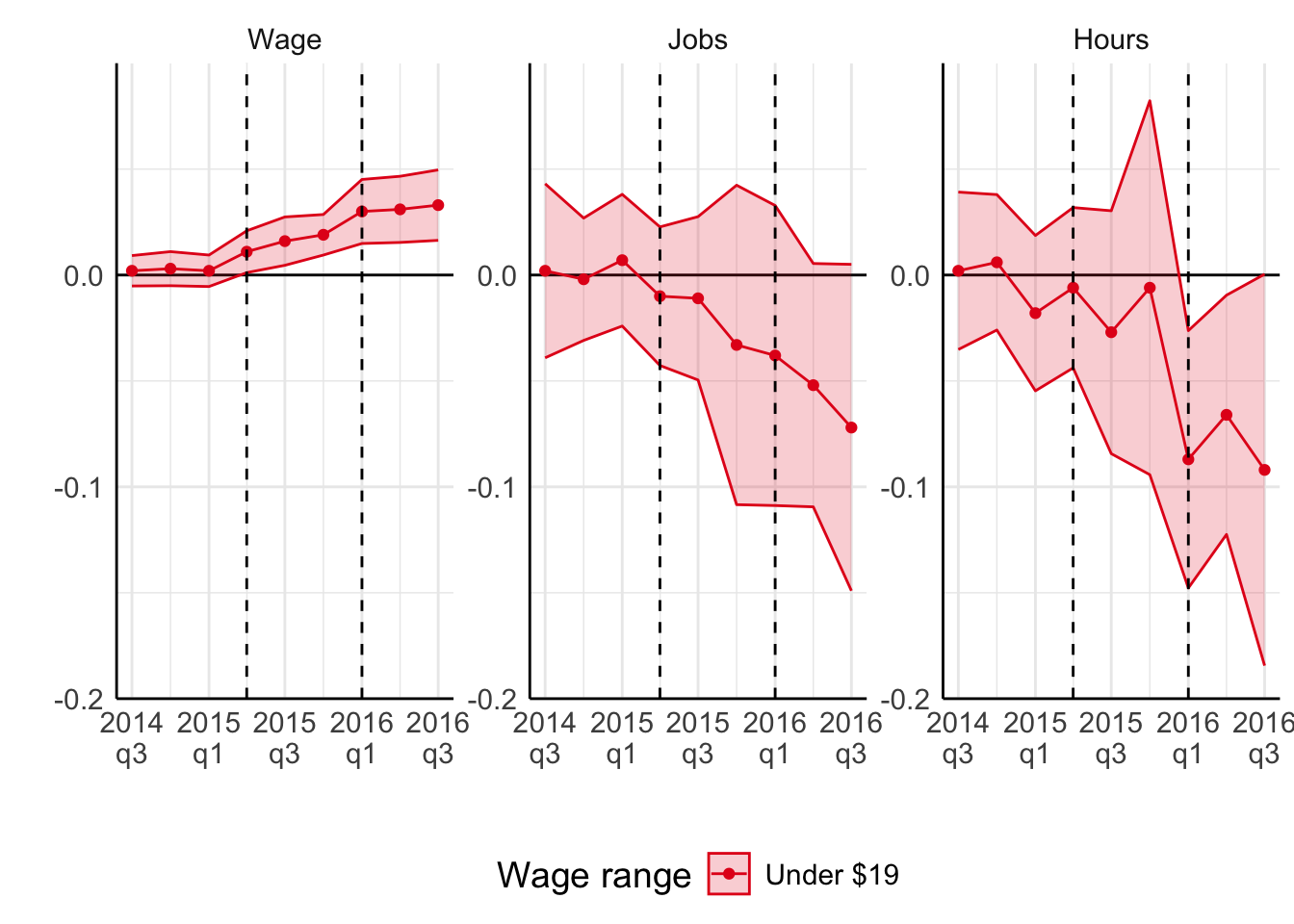

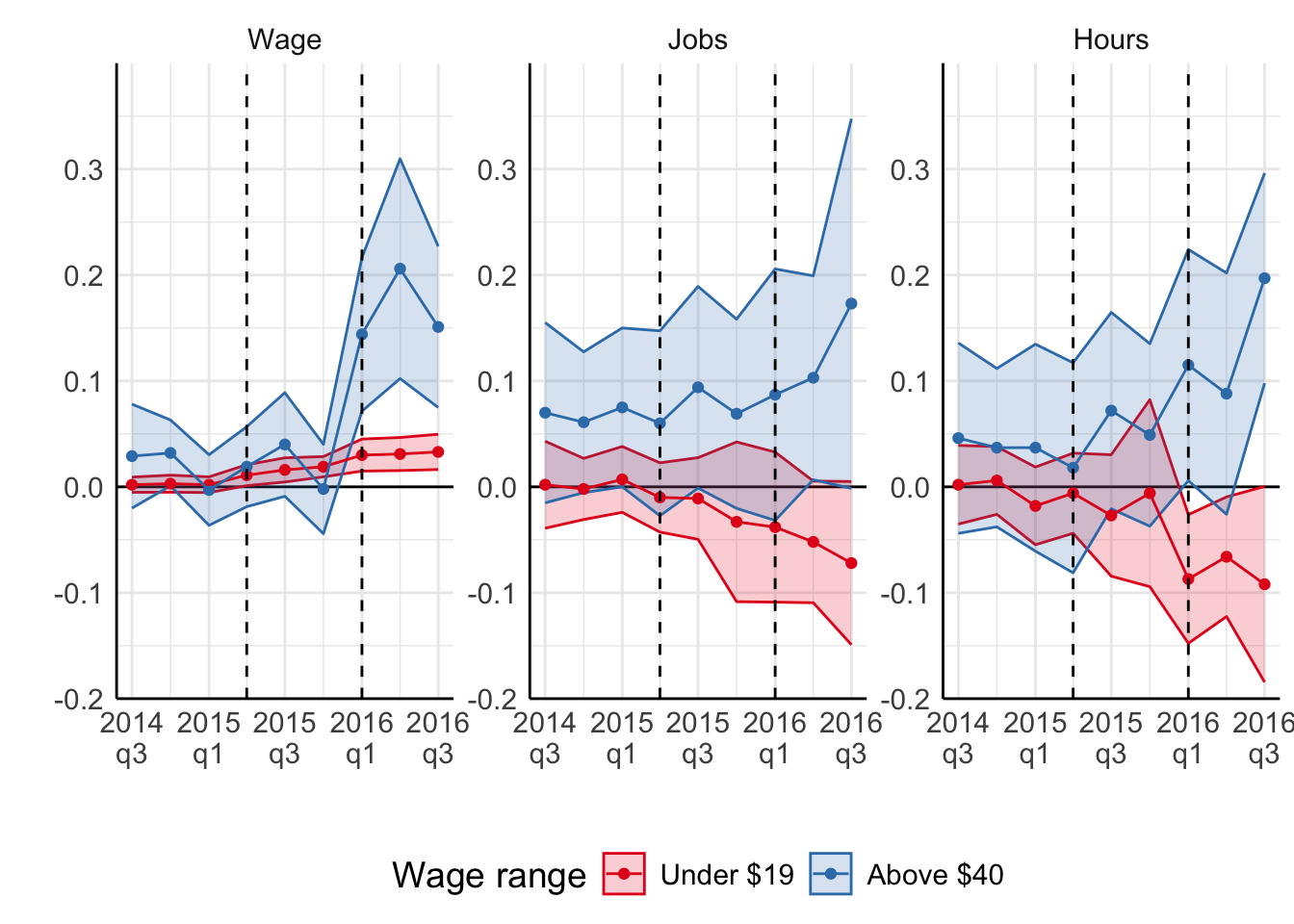

Jardim et al. (2022)

Seattle \(\uparrow\) min wage from $9.47 up to

- $11 in April 2015

- $13 in January 2016

Causal design:

- synthetic control: weighted average of other counties match pre-Seattle

- nearest neighbour matching: find “closest” worker outside of Seattle matching treated worker in Seattle

Minimum wage and employment

Jardim et al. (2022): synthetic control

Minimum wage and employment

Jardim et al. (2022): synthetic control

Minimum wage and employment

Jardim et al. (2022)

- Negative effect on hours worked stronger than on employment

- Experienced workers are better off

However,

- Potentially cascading effect

- Excluded large low-wage employers (like McDonald’s)

Reich, Allegretto, and Goddy (2017)

same policy + synthetic control = no change in employment

Minimum wage and other margins

Review in Clemens (2021)

- Price pass-through (Leung 2021; Renkin, Montialoux, and Siegenthaler 2022)

- Non-wage labour cost (Clemens, Kahn, and Meer 2018)

- Flexibility (theoretical Clemens and Strain 2020)

- Effort (Ku 2022; Coviello, Deserranno, and Persico 2022)

- Firm profit (Draca, Machin, and Van Reenen 2011; Bell and Machin 2018)

- Firm exit (Luca and Luca 2019; Dustmann et al. 2022)

Summary

Basic static and dynamic models of labour demand

Application to minimum wage policy

- Ongoing research (little consensus)

- Clear that basic models are insufficient

- Non-wage margins important and can interact with labour supply

Next lecture: Job Search on 03 Sep